Who We Are

Founded in 1970, Ansys employs over 5,000 professionals, many of whom are expert M.S. and Ph.D.-level engineers in finite element analysis, computational fluid dynamics, electronics, semiconductors, embedded software and design optimization. Our exceptional staff is passionate about pushing the limits of world-class simulation technology so our customers can turn their design concepts into successful, innovative products faster and at lower cost. As a measure of our success in attaining these goals, Ansys has been recognized as one of the world's most innovative companies by prestigious publications such as Bloomberg, Business Week and FORTUNE magazines.

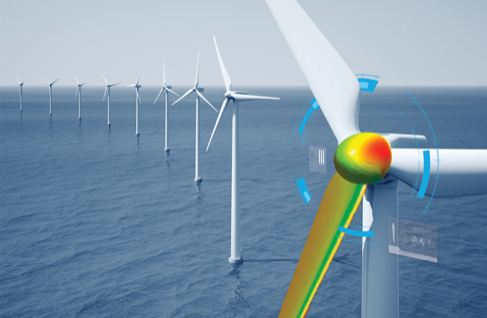

What We Do

Engineering simulation is our sole focus. For 50 years, we have consistently advanced this technology to meet evolving customer needs. Ansys develops, markets and supports engineering simulation software used to predict how product designs will behave in real-world environments. We continually advance simulation solutions by developing or acquiring the very best technologies; integrating them into a unified simulation platform capable of complex, multi-physics solutions; providing system services, including high-performance computing (HPC) and Cloud solutions, to manage simuation processes and data.